In my last post I explained that I have in the past lost huge amounts of money when I have not closed my trades before the market has gone in-play / in-running. This has normally been because I have made a loss from my trades pre-race which I haven’t been willing to accept and so in the heat of the moment I’ve decided to gamble by not closing the trade, in the hope I can close it in-play at a break-even point. Or by some miracle my lay-bet comes good when the favourite falls at the first hurdle, etc. This has of course then resulted in me losing far more money than if I had simply accepted the loss pre-race and redded-up.

Looking through my results in the database I keep, these catastrophic losses almost always occurred the next race after having had a loss that was large relative to the average profit I make per race. I was on-tilt from the previous loss. Then, if I had a losing trade on the next race, the “red mist” of gambling would descend on my mind and - bingo – I put my whole bank on the line, win or lose (and nearly always lose!). There was something very final about doing it, a threat to the market gods that they weren’t treating me right! Maybe subconsciously I wanted it all to end?

I’m sure a psychologist (or is it psychoanalyst, I’m never sure of the difference?) would be able to explain this behaviour and maybe one day I’ll read-up about it. The reason for calling my blog Mind Games is because I feel that in these situations, my mind has played games with me. I mean, I KNOW I shouldn’t go in-play with my whole balance on the line, but I’ve done it. Repeatedly.

I’ve read enough self-help books on various subjects to know that one question they would ask is, ”in what way does losing by going in-play serve or benefit you?”. Now my first reaction to that would be are you f*ing insane?! But, if I really had to find a reason, I think the most significant one could be to end the pain of not winning. Another might be the thrill of gambling, which I miss. Another might be because I feel that it is wrong that I made a trading loss on that particular race – because of a spoofer, or because the weight of money was pointing the other way, or because the race commentator didn’t mention all the horses were in the stalls etc etc etc. All excuses.

In the meantime, I have found that by changing a whole bunch of things just by small amounts that I am now able to break this destructive pattern of behaviour.

From reading other blogs and comments I know there are other traders out there who are having the same experience. I think it is the same mindset that gamblers have where “just one win” will get them out of the financial hole they are in. I have the feeling that the non-traditional gamblers out there who are traders may not really know what we are talking about and simply say, “don’t go in-play, you’ll end up losing your bank”. Of course they are right and I wish I hadn’t had to go on this long painful journey to stop doing it myself – I envy their ability to not think / behave in this way.

Anyhow, for me at least, there is not a magic answer but a whole series of factors which when taken together produce the desired result. Some of them I am probably not consciously aware of, but over the past few days, I’ve noted down the ones I’ve thought of as I’ve been trading. I really hope they are useful to other traders out there, but I’m certainly not saying I have all the answers or that what I’ve done will help curb this behaviour completely, or even a little bit, for other people. Obviously I hope they are helpful but I am not encouraging anyone to continue trading who wants to stop / has no money left etc. I don't know whether anyone can become a successful trader given the right circumstances, but apparently 90% or 95% of traders fail.

I mentioned at the end of my last post that, for me, I feel the most important factor in becoming consistently profitable was finding an edge (err – sorry for saying the obvious!). Of course, you can take the time to discover what works for you whilst using very small stakes. I was too anxious to start earning salary-sized amounts and I escalated my stakes way, way too quickly.

After trading on-and-off for 2 years, I started using stakes TEN TIMES smaller. For a couple of races it felt ridiculous, but then I actually started learning how to trade instead of wasting effort in abject fear of losing money I couldn’t afford.

By using small stakes you don’t have the pressure of taking a loss that is a significant amount of money in the real world, so you don’t need to risk going in-play to get out of the hole, so you don’t end-up blowing your (small) bank. That in turn gives you confidence and belief that you are indeed a successful trader, that in turn means you can start taking a profit most days from your trading, that in turn gives you respect for your money and trading stake, that in turn means that the last thing in the world you want to do is squander your hard-earned stake.

I actually think that, for me, it was important to earn my trading bank rather than just lumping it into my account from a bank card.

Treat it like a job! Hard work pays-off, it also gives you perspective on the money you are using. If your expectation of a good day is to make less than 50% of your bank, then remember it will take more than 2 good days of trading to recover from a total loss. If you normally make 20% a day then that’s a whole week wasted to get back to scratch. Why throw away all that time?

Can you imagine being in a job as an employee and telling your boss that you just threw away a week’s earnings for the business because you got a bit steamed-up?!!! Well, you are the boss, so don’t do it to yourself!

Do not put yourself under pressure to make a certain amount a day, week or month until you have proven you can make a profit for a period of over a month or so (only risking small stakes). If you’re like me then you won’t want to wait a whole month proving your edge, however I can say from bitter experience that it will be expensive using the maximum stakes you can afford whilst experimenting!

At first, just concentrate on trying to make a profit of any amount each day. Once I stopped trying so hard to make a set amount and just enjoyed being in profit, I found that after a few weeks the profits on some days started far exceeding the expectations I used to set. My strike-rate and consistency improved and I could enjoy my trading too. I felt safe to gradually increase my trading bank slightly, but I'm still way off what I used to use. Nowadays I concentrate on increasing my % profit for the day, not my trading bank size.

If I knew back at the start what I know now, I would have borrowed the money for my living expenses instead of for my trading bank and not expected to make a living from trading right away. The pressure of trying to make a living by trading must have been one of the factors that made it hard for me to accept losses.

It is a vicious circle that leads to blowing your bank and it starts with a loss. If you made a profit before every race then you’d never go in-play! Other than by genuine accident – and that can happen...

Did you know that AtTheRaces has a much larger delay than Racing UK? It’s only something like a couple of seconds extra, but relative to the overall delay from live that’s quite a bit. If you like trading right up to the last second then this could be one reason why you end-up going in-play by accident.

Furthermore, if you use the red-button feature of ATR, the delay is increased again. Just bear this in mind when on this channel and it may save you a chunk of your bank! Watch a couple of race finishes whilst on the red-button and see how much sooner Betfair suspend the market than you see the winner cross the line. Scary!

I really like the red-button feature as you can skip the diabolical daytime TV adverts!! If I hear Michael Parkinson say, “I’ve met thousands of interesting people”, or that old fart in the garden blabbing on about being organised, or Anne Diamond selling her soul for some gold, one more time I’ll be throwing my nice new lcd tv out of the window onto the lawn!!! It’s enough to put you on tilt. No, really!

The best way of avoiding large pre-race losses has to be to close losing trades quickly (okay, the best way is to get the market direction right!). Closing losing trades quickly, before your mind kicks-in saying,”ooh that loss is going to be big, don’t take it, gamble, double-up your stakes and really put your whole week on the line”! Just do it quickly, automatically, as a part of your trading style and it saves a lot of pain down the line. I am so often pleasantly surprised that the loss amount is less than I expected before closing the trade, that it actually gives me a boost. Then I hammer the next opportunity hard.

It has taken me a long time to get good at closing losses quickly and at the same time to learn how to let winning trades ride-out. They are two different disciplines and it is fun trying to master them, essential I suppose.

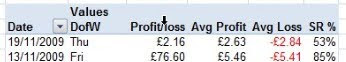

Keeping records is also really important to gain perspective on your trading. I’ve kept a database of all the spreadsheets I’ve downloaded from Betfair P&L and the Bet History pages for years. I made all sorts of weird and wonderful reports. A couple of weeks ago I started making a totally new system in Excel, it is really simple and at the moment I’m finding it very useful {Update Dec 2020 - see Results Summary Spreadsheet

here}. I find that average loss per race is a very revealing stat. It is like a barometer of how consistent / on-tilt I was on any given day. Here is a graph from my results this month – just as well my strike rate is high!

You can see that my losses have been much more volatile for the past two weeks. This is partly because I’ve been trying to let my winning trades run for longer (with some success), however it is a totally different mindset to closing losing trades quickly and I’ve been slipping in that department.

Also, all the thinking I’ve been doing to write this post about going in-play has affected me a little, I think it has brought the old demons back to mind and also perhaps I felt over-confident that I don’t go in-play anymore and hence I’ve had some scrapes with some small liabilities going in-play which have increased the trading loss slightly. I’m not perfect! I need to be constantly vigilant.

Next up is “Respect”. No, I’m not trying to “get down” wiv da yoof, but when I started using stakes of £2,000 to £3,000 after only trading for a few months, I lost respect for that money. I forgot what it represented. I was supposedly only trying to nick a tenner or so a race so it felt safe and non-risky.

When I gambled, I built up my stakes very gradually (from the age of 16!) and a normal bet was £200, the largest I ever had was £400. Then I started trading and hey-presto, before long I ended up with £1,500 on some dodgy favourite of which I hadn’t even glanced at the form. Even I wasn’t that reckless when gambling!

It’s a funny thing this trading business, it appears to offer a safer form of gambling, but if you don’t “respect” it, you are going to have losses that you could only dream of previously.

The thing about losses is that not only have you lost money but you have wiped-out the profit potential of the day for the next day too. It may be obvious but it is significantly worse to lose on the day than to break-even for the day, however, I used to take more and more risk towards the end of the day when I wasn’t ahead – similar to when I was behind, crazy!

Looking at the markets before the start of racing is helpful as you then can set expectations for the day. If the opportunities for the day weren’t great then you shouldn’t be blaming yourself if things aren't going so well.

If there are lots of strong favourites and loads of money in the markets then it will probably be a fun day. If there isn’t then you can’t change that fact, but you can adjust your expectations.

Be aware of the next race – another reason why you shouldn’t go in-running is because you may miss a good trading opportunity for the next race. Not all races are the same. The "get-out" stakes at the end of the day may be the worst possible time to try and recover losses as they tend to be low quality and have low liquidity - leave it until tomorrow. Try to see the day as 20 races, not 1. This is the hardest part when the "red mist" of going on-tilt / gambling descends!

The final piece of the puzzle for me was trading bank management.

If you start with £100 and lose 50% on the first day, you need to make 100% (i.e. double) of your remaining bank of £50 in order to get back to where you were. If you accept on the less good days that a small profit is okay, then at least you have moved forward, albeit slowly, but you don't have any losses to recover the next day. You still have your whole bank to work with and the potential to have a great day tomorrow.

Without any form of bank management you are seriously weakening yourself with losses. If you use 100% of your trading bank throughout the day then if you have a significant loss your ability to recover is weakened, simply because you don't have as much money left to trade with to recoup the losses.

Some traders seem to have very strict bank management and use only 5% on any one trade. Whilst this is very prudent, the problem I had when starting out is that I couldn't afford to have 95% of my trading bank sitting around unused.

The compromise I use successfully now is that I have an amount twice the size of my trading bank in my Betfair account (the Australian wallet is useful for keeping the extra safe). This means that if I have some losses at the start of the day, I can continue trading with my normal stake size, even if the worst possible scenario occurred (i.e. going in-play with my whole trading stake exposed and this went on to lose, or a Betfair crash – last Tuesday at 5:15, anyone?!).

As I've said, I don't do that anymore! But I do find it useful if I have a bad start to the day that I can continue with my trading and not have to worry about reducing my stake size. Equally, when I have a good start to the day, I don't increase my stake size. I always withdraw my profits for the day unless I lost the previous day in which case I only withdraw once the loss has been exceeded (hopefully the next day). I find it very motivational to see regular amounts coming into my bank account!

The name of the game is to be consistent and not take more risk than necessary, keep a level-head and come out at the end of the day with a smile on your face!

I'd like to hear from other traders who have ideas (or proven strategies!) on how they have curbed this temptation to go in-play. If you found this post useful I’d really appreciate you linking to it from your blog / putting me on your blog list, I want to get more comments going and I need more readers for that!

Cheers, MG